Finance

5StarsStocks.com Best Stocks: Top Picks for 2024

Investing in the stock market can be a daunting task, especially with the constant fluctuations and an overwhelming amount of information available. Whether you’re a seasoned investor or a beginner, making informed decisions is crucial. This is where platforms like 5StarsStocks.com come into play, offering curated lists of the best stocks to consider for your portfolio.

Understanding 5StarsStocks.com

Before diving into the top stock picks, it’s essential to understand what 5StarsStocks.com is all about. This platform specializes in providing investors with comprehensive analyses of stocks, focusing on those with the potential for high returns. The site’s goal is to empower investors by offering insights into stocks that have been thoroughly vetted by financial experts.

5StarsStocks.com not only lists stocks but also provides detailed explanations and projections, helping you understand why a particular stock is worth your attention. From blue-chip stocks to emerging market leaders, the platform covers a broad spectrum of investment opportunities.

Why 5StarsStocks.com Best Stocks Stand Out

When it comes to selecting the best stocks, 5StarsStocks.com uses a rigorous evaluation process. The platform’s analysts consider various factors, including company fundamentals, market trends, and economic indicators. This meticulous approach ensures that only the most promising stocks make it onto their recommended list.

One of the unique aspects of 5StarsStocks.com best stocks is the focus on long-term growth. The platform isn’t just about chasing quick gains but is committed to identifying stocks with sustainable growth potential. This is crucial for investors who are looking to build a solid, long-term portfolio.

Also Read: Exploring NFTRandomize: The Next Big Thing in the NFT Ecosystem

Top 5 Stocks Recommended by 5StarsStocks.com

- Tech Titans: Technology companies continue to dominate the stock market, and 5StarsStocks.com has identified several key players that are poised for further growth. These include industry giants that have consistently delivered strong financial results and innovative products.

- Healthcare Innovators: With advancements in biotechnology and pharmaceuticals, the healthcare sector remains a hotbed for investment. 5StarsStocks.com best stocks in this category are companies that are at the forefront of medical innovation, offering both stability and growth potential.

- Sustainable Energy Leaders: As the world shifts towards renewable energy, investing in companies that are leading this charge is not just a trend but a smart financial move. 5StarsStocks.com highlights stocks in the sustainable energy sector that are expected to benefit from global environmental policies and technological advancements.

- Emerging Markets: Emerging markets present unique opportunities for growth, albeit with higher risks. 5StarsStocks.com carefully selects stocks from these regions, focusing on companies with strong growth potential and strategic importance in their respective markets.

- Consumer Goods Giants: Even in times of economic uncertainty, consumer goods companies often provide steady returns. 5StarsStocks.com best stocks in this category include companies with a strong brand presence and consistent demand for their products.

How to Use 5StarsStocks.com Best Stocks in Your Investment Strategy

To make the most out of 5StarsStocks.com best stocks, it’s essential to align these picks with your investment strategy. Are you looking for long-term growth or short-term gains? Do you prefer a diversified portfolio or are you focused on a specific sector? Understanding your financial goals will help you decide which of the recommended stocks are the best fit for you.

For instance, if you’re a conservative investor, you might prioritize blue-chip stocks with a history of steady dividends. On the other hand, if you’re more aggressive, you might focus on emerging markets or tech startups that offer higher growth potential but come with more volatility.

Diversification: A Key Strategy with 5StarsStocks.com Best Stocks

Diversification is a crucial element of any successful investment strategy, and 5StarsStocks.com makes it easier by offering stock recommendations across various sectors. By investing in a mix of stocks from different industries, you can reduce your risk and increase your chances of achieving consistent returns.

5StarsStocks.com best stocks cover a wide range of industries, from technology and healthcare to consumer goods and energy. This diversity allows investors to create a balanced portfolio that can weather market fluctuations.

5StarsStocks.com Best Stocks for Different Risk Tolerance Levels

Every investor has a different risk tolerance, and 5StarsStocks.com acknowledges this by providing stock picks that cater to various risk appetites. Whether you’re a conservative investor looking for low-risk options or a risk-taker eager to explore high-growth opportunities, 5StarsStocks.com has you covered.

For low-risk investors, the platform often recommends established companies with strong balance sheets and a history of steady returns. For those with a higher risk tolerance, 5StarsStocks.com best stocks might include smaller companies with significant growth potential but more volatility.

The Importance of Staying Updated with 5StarsStocks.com

The stock market is dynamic, with prices and trends changing rapidly. Staying updated with the latest insights and recommendations from 5StarsStocks.com can give you a competitive edge. The platform regularly updates its stock picks based on the latest market data and economic trends, ensuring that you always have access to the most current information.

Conclusion

In the fast-paced world of stock investing, having a reliable source of information is invaluable. 5StarsStocks.com best stocks offer a well-researched, carefully curated list of investment opportunities that can help you achieve your financial goals. Whether you’re a novice investor or a seasoned pro, the insights provided by 5StarsStocks.com can guide you in making informed decisions that lead to long-term success.

Also Read: Crypto30x: Maximizing Returns in the Cryptocurrency Market

FAQs

What makes 5StarsStocks.com best stocks reliable?

5StarsStocks.com uses a rigorous analysis process, considering various factors such as company performance, market trends, and economic indicators, ensuring that their stock picks are well-researched and promising.

How often are the stock picks updated on 5StarsStocks.com?

The stock picks are regularly updated to reflect the latest market trends and economic developments, ensuring that investors have access to the most current information.

Can I find stocks from emerging markets on 5StarsStocks.com?

Yes, 5StarsStocks.com best stocks include picks from emerging markets, focusing on companies with high growth potential and strategic importance.

Is 5StarsStocks.com suitable for beginners?

Absolutely. 5StarsStocks.com provides detailed explanations and projections for each recommended stock, making it easier for beginners to understand and make informed investment decisions.

Does 5StarsStocks.com only recommend large-cap stocks?

No, 5StarsStocks.com offers a variety of stock picks, including large-cap, mid-cap, and small-cap stocks, catering to different investment strategies and risk appetites.

How can I align 5StarsStocks.com best stocks with my investment goals?

It’s important to understand your financial goals and risk tolerance. You can then select stocks from the 5StarsStocks.com best stocks list that align with your long-term or short-term investment strategy.

Finance

5starsstocks.com Staples: Best Consumer Stocks to Own

In the world of investing, not all stocks are created equal. Some shine brightly for a moment and fade, while others stand firm through every economic storm. Welcome to the world of 5starsstocks.com staples — a niche that might not be flashy but is as dependable as a well-stocked pantry. These companies provide everyday products like toothpaste, soap, and cereal, making them essential in people’s lives. As a result, they tend to perform consistently even when the economy doesn’t.

This article explores the advantages of investing in consumer staples, showcasing why they’ve become a favorite among smart investors. We’ll break down what consumer staples are, how they work, and which stocks have proven themselves time and time again.

What Are 5starsstocks.com Staples?

5starsstocks.com staples refer to publicly traded companies known for selling consumer goods people use regularly—regardless of economic conditions. These include food, beverages, household products, and hygiene items. Essentially, they sell the things people can’t go without.

This kind of stock is considered “defensive” because it tends to stay strong even during economic downturns. When times are tough, people may not buy a new car, but they still buy toilet paper.

Why Staples Stocks Are Always in Demand

There’s a reason these companies are called “staples.” They’re built into our lives. Whether the economy is booming or facing a recession, people still buy soap, cereal, and canned goods. This constant demand leads to steady income for these businesses, which is excellent news for investors.

The regularity in cash flow makes them less risky compared to tech or energy stocks. Moreover, staples companies usually pay dividends, making them attractive for long-term growth and income.

Economic Uncertainty and Safe Investing

During uncertain times, the stock market can feel like a rollercoaster. However, 5starsstocks.com staples tend to provide a smoother ride. Investors flock to these stocks because of their reliability. While other sectors face ups and downs, consumer staples show resilience. That makes them a go-to for investors looking to preserve capital and receive stable returns.

Dividends: A Big Bonus in Staples

One of the best perks of investing in staples is the regular dividend payments. Since staples companies have steady income, they often share profits with their shareholders through dividends. Over time, these payments can compound and help build wealth without needing to sell any shares.

For example, a company like Procter & Gamble has been paying dividends for over 130 years. That’s a track record of consistency that’s hard to beat!

Top 5starsstocks.com Staples to Watch

Let’s explore some of the top performers in the staples category.

Procter & Gamble (PG)

This company sells brands like Tide, Gillette, and Pampers. Its wide range of household and personal care products makes it a giant in the industry.

Coca-Cola (KO)

People may argue over soda’s health effects, but there’s no denying Coca-Cola’s staying power. With a presence in over 200 countries, it’s a global brand that pays consistent dividends.

PepsiCo (PEP)

Not just a drink company—PepsiCo also owns snack brands like Lays and Doritos. This mix of beverages and food gives it stability and diversity.

Colgate-Palmolive (CL)

From toothpaste to pet food, Colgate-Palmolive covers a wide spectrum. Their products are found in nearly every household.

Unilever (UL)

This global giant offers food, beverages, and personal care items. Brands like Dove, Hellmann’s, and Ben & Jerry’s are part of its portfolio.

Performance of Staples Over Time

When looking at market trends, staples have often outperformed during recessions. For example, during the 2008 financial crisis, the S&P 500 dropped significantly, but many staples stocks held their ground. This shows how they offer a safety net when the rest of the market is falling.

Staples vs. Other Sectors

Compared to tech or energy stocks, consumer staples may not offer explosive growth. However, they do provide peace of mind. Tech stocks can be risky, especially for beginner investors. Staples, on the other hand, are more forgiving, making them a wise option for those focused on long-term returns.

Inflation Protection Through Staples

Inflation eats into spending power, but consumer staples companies can often pass those costs onto customers. Since people still need the products, they’re willing to pay a bit more, helping the companies maintain profits.

How to Start Investing in 5starsstocks.com Staples

If you’re new to investing, consider starting with a diversified fund focused on consumer staples. Many ETFs (exchange-traded funds) offer exposure to top staples stocks, allowing you to invest in a wide range of companies with one purchase.

Look for:

-

XLP (Consumer Staples Select Sector SPDR Fund)

-

VDC (Vanguard Consumer Staples ETF)

These funds include the biggest names in the staples category and are ideal for long-term holdings.

Long-Term Growth with Lower Risk

Long-term investing in staples isn’t about quick riches—it’s about slow and steady growth. Over time, companies in this sector can deliver strong total returns through a combination of rising stock prices and dividends.

Are Staples Boring? Maybe, but They Work

Some may call these stocks “boring,” but boring can be beautiful when it comes to investing. A stock that quietly grows over the years, pays you dividends, and keeps your portfolio stable is exactly what most investors need.

Key Features of Staples Stocks

-

Stable demand

-

Reliable dividends

-

Global presence

-

Defensive sector performance

-

Less volatility

Signs a Staples Stock is Strong

When choosing a staples stock, look for:

-

Strong brand recognition

-

Consistent revenue and earnings

-

Dividend history

-

Low debt levels

-

International reach

Impact of Technology on Staples

Though not traditionally high-tech, many staples companies are embracing technology to improve supply chains, marketing, and sustainability. This helps them stay relevant and efficient in an evolving business world.

Global Growth Opportunities

Emerging markets offer new customers for staples companies. As more people in developing nations join the middle class, demand for quality consumer goods will grow. This opens new revenue streams for established staples brands.

Risks to Consider

Even staples come with some risk. If consumer preferences shift or a company fails to innovate, it may fall behind. Also, during economic booms, staples might underperform compared to growth sectors.

Diversifying Within the Staples Sector

Even within this stable category, it’s smart to diversify. You might choose some food-focused companies, a few personal care brands, and even cleaning product makers. This balances your exposure and helps protect your portfolio.

ESG Investing in Staples

Environmental, social, and governance (ESG) factors are becoming more important. Many investors want to back companies that care about sustainability and fair labor practices. Staples companies are responding by making their operations greener and more ethical.

How to Track Staples Performance

Use financial websites like Yahoo Finance or MarketWatch to follow the performance of staples stocks. Pay attention to earnings reports, dividend updates, and industry news.

Building a Dividend Portfolio with Staples

By combining several dividend-paying staples stocks, you can create a portfolio that provides income for years. Reinvesting those dividends will lead to even more growth over time.

Are Staples Right for You?

If you want a low-risk, consistent part of your portfolio, staples may be a perfect match. They don’t require constant watching, making them ideal for beginners or those who prefer a more hands-off approach.

Final Thoughts on 5starsstocks.com Staples

In a world of unpredictable stock moves, 5starsstocks.com staples shine as a reliable option. These stocks may not make headlines every day, but they offer what investors value most: consistency, dividends, and peace of mind.

Whether you’re a beginner looking for your first investment or a seasoned investor building a retirement fund, consumer staples should not be overlooked.

see also 5StarsStocks.com Best Stocks: Top Picks for 2024

FAQs

What are 5starsstocks.com staples?

They are dependable stocks that include companies selling everyday consumer goods like food and personal care items.

Why invest in consumer staples?

Because they are less risky and perform well in both good and bad economies, offering stable dividends.

Do staples stocks grow fast?

Not usually. They grow slowly but steadily and are great for long-term investing.

Which staples stocks pay the best dividends?

Companies like Procter & Gamble, Coca-Cola, and Unilever are known for strong, regular dividend payments.

Are staples safe during a recession?

Yes, these companies often do better during recessions since their products are always needed.

How do I start investing in staples?

You can buy individual stocks or use ETFs like XLP or VDC for diversified exposure.

Finance

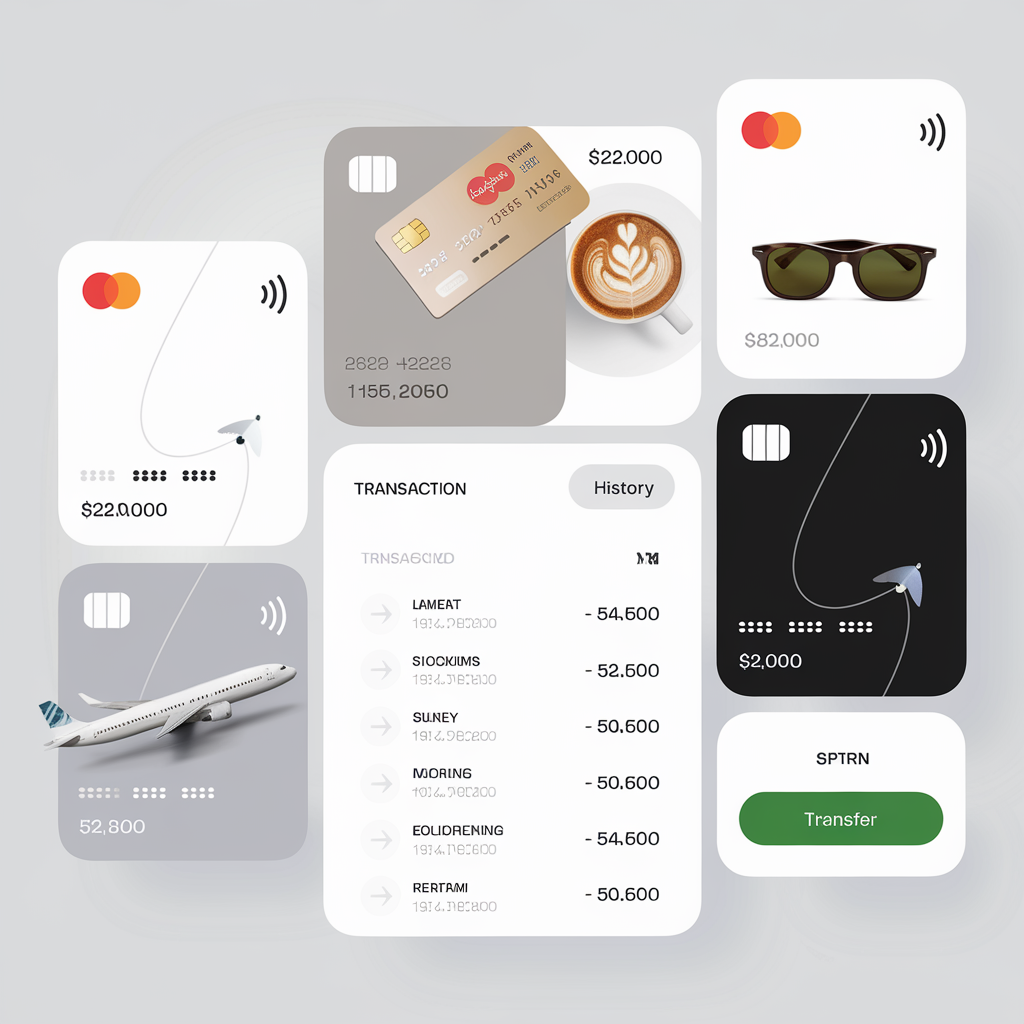

Coyyn Digital Banking Transforming Financial Services

In the fast-evolving world of fintech, Coyyn Digital Banking has emerged as a leader, offering streamlined, secure, and user-friendly financial solutions. Its innovative services cater to both individuals and businesses, redefining the way people interact with their finances. In this blog, we delve deep into the benefits, features, and transformative potential of Coyyn Digital Banking.

What Is Coyyn Digital Banking?

Coyyn Digital Banking is a fintech platform designed to provide users with seamless access to financial tools through digital channels. Unlike traditional banks, Coyyn leverages technology to enhance banking efficiency and accessibility, enabling users to perform a wide range of financial activities anytime, anywhere.

Why Choose Coyyn Digital Banking?

For those seeking a modern banking experience, Coyyn Digital Banking stands out due to its convenience, robust security measures, and advanced features. Whether managing personal savings or overseeing business transactions, Coyyn ensures a hassle-free experience.

Features of Coyyn Digital Banking

1. Seamless Account Management

Coyyn allows users to monitor account balances, transfer funds, and review transaction history through an intuitive interface. The platform simplifies everyday banking, eliminating the need for physical visits to a branch.

2. Advanced Security Protocols

Security is paramount in digital banking, and Coyyn employs cutting-edge encryption and authentication methods to safeguard user data and transactions. Features like two-factor authentication and biometric verification ensure peace of mind.

3. Real-Time Payment Processing

Coyyn offers instant payment solutions, allowing users to send and receive money in real-time. This feature is particularly valuable for businesses requiring quick and reliable payment processing.

4. Personalized Financial Insights

The platform provides tailored insights into spending patterns and financial goals. Coyyn’s analytics tools help users make informed decisions about savings, investments, and expenses.

5. Business-Friendly Tools

Coyyn supports businesses with tools like bulk payment processing, invoicing solutions, and integration with accounting software. These features streamline operations and enhance productivity.

Benefits of Coyyn Digital Banking

Convenience at Your Fingertips

With Coyyn, banking is no longer confined to traditional hours or physical locations. Users can access their accounts from any device, ensuring ultimate flexibility.

Cost-Efficiency

Digital banking reduces overhead costs associated with traditional banking, resulting in lower fees for users. Businesses, in particular, can save significantly on transaction costs.

Enhanced Financial Control

Coyyn empowers users to take control of their finances with real-time notifications, detailed reports, and budgeting tools. Staying on top of financial health has never been easier.

Eco-Friendly Banking

Coyyn’s paperless processes contribute to environmental sustainability. From digital statements to online payments, every interaction minimizes waste.

How Coyyn Digital Banking Stands Out

1. Intuitive User Interface

Coyyn’s design prioritizes user experience, offering a clean and intuitive interface. Whether you’re tech-savvy or new to digital banking, navigating Coyyn’s platform is effortless.

2. Constant Innovation

Coyyn regularly updates its features to stay ahead in the competitive fintech landscape. By embracing emerging technologies like blockchain and AI, it continues to offer cutting-edge services.

3. Inclusive Banking Solutions

Coyyn caters to diverse financial needs, making its services accessible to individuals, small businesses, and large enterprises alike. Its inclusive approach ensures no one is left behind in the digital banking revolution.

How to Get Started with Coyyn Digital Banking

Step 1: Sign Up

Visit Coyyn’s website or download the mobile app to create an account. The registration process is quick and user-friendly.

Step 2: Verify Your Identity

For security purposes, Coyyn requires users to verify their identity through a simple process that ensures compliance with banking regulations.

Step 3: Explore the Features

Once registered, explore the platform’s features to understand how Coyyn can meet your financial needs. From personal savings to business transactions, the possibilities are endless.

Use Cases: How Coyyn Simplifies Life

For Individuals

- Budget Management: Analyze spending habits and set realistic financial goals.

- Quick Transfers: Send money to friends and family instantly, even across borders.

For Businesses

- Payroll Processing: Automate salary disbursements with bulk payment tools.

- Invoice Management: Streamline invoicing and keep track of payments with ease.

Coyyn Digital Banking vs. Traditional Banks

| Feature | Coyyn Digital Banking | Traditional Banks |

|---|---|---|

| Accessibility | 24/7 via app or web | Limited to branch hours |

| Transaction Speed | Real-time | May take 1-3 business days |

| Fees | Lower | Often higher |

| Eco-Friendliness | Paperless | Paper-intensive |

| Customization | Highly personalized tools | Limited options |

The Future of Digital Banking with Coyyn

The rise of platforms like Coyyn Digital Bank signifies a shift towards a fully digital financial ecosystem. As technology advances, Coyyn is poised to integrate innovations like blockchain for secure transactions and AI-driven insights for predictive financial planning.

By embracing Coyyn Digital Bank, users not only gain access to efficient tools but also position themselves at the forefront of modern banking.

FAQs

What makes Coyyn Digital Bank unique?

Coyyn combines advanced technology with user-centric design to offer convenient, secure, and personalized banking solutions.

Is Coyyn suitable for businesses?

Absolutely! Coyyn offers a range of features designed to support business operations, from payment processing to invoicing.

How secure is Coyyn Digital Banking?

Coyyn employs advanced security measures, including encryption and biometric authentication, to protect user data and transactions.

Can I access Coyyn Digital Bank on multiple devices?

Yes, Coyyn supports access across devices, ensuring seamless transitions between desktop and mobile platforms.

Are there fees associated with Coyyn Digital Banking?

Coyyn offers competitive pricing with lower fees compared to traditional banks, making it a cost-effective choice.

How do I contact Coyyn for support?

Coyyn provides customer support via its app, website, and helpline to address any queries or issues promptly.

see also Navigating the World of Financial Technology with Fintech Zoom.com

Conclusion

Coyyn Digital Bank represents the future of financial services, combining convenience, security, and innovation to meet the needs of modern users. Whether you’re an individual looking to manage your finances more effectively or a business aiming to streamline operations, Coyyn provides the tools and resources you need. By adopting Coyyn, you’re not just banking—you’re embracing a smarter way of managing your financial life

Finance

Best 5starsstocks stocks to invest in 2024

Investing in the stock market is a journey that requires careful planning, thorough research, and a good understanding of the market dynamics. Among the myriad options available, 5starsstocks stocks to invest in stand out as some of the most reliable and promising investments. These stocks are typically rated highly by analysts and financial experts, indicating strong potential for growth, stability, and overall performance. But what exactly makes a stock a “5-star” investment, and why should you consider adding them to your portfolio?

In this comprehensive guide, we will explore the world of 5-star stocks, delving into what makes them a solid choice for investors and how you can strategically incorporate them into your investment strategy. Whether you’re a seasoned investor looking to refine your portfolio or a newcomer aiming to make informed decisions, understanding 5starsstocks stocks to invest in can significantly enhance your investment outcomes.

Understanding 5-Star Stock Ratings

To fully grasp the value of 5-star stocks, it’s essential to first understand what these ratings signify. A 5-star rating is a designation given by analysts and financial institutions to stocks that exhibit strong potential for high returns, coupled with lower-than-average risks. These ratings are typically derived from a comprehensive analysis of various factors, including a company’s financial health, growth prospects, market position, and management quality.

The Importance of 5-Star Ratings in Stock Investment

When navigating the vast sea of investment options, 5starsstocks stocks to invest in serve as a reliable compass, guiding investors toward stocks that are likely to perform well in the future. These ratings are not merely arbitrary labels; they are the result of meticulous research and analysis, often reflecting the collective wisdom of industry experts. For investors, this means a reduced need for extensive personal research, as 5-star ratings already consider many of the crucial factors that drive stock performance.

What Makes a Stock a 5-Star Investment?

Several key elements contribute to a stock receiving a 5-star rating. These include:

- Strong Financial Performance: Companies with robust financial statements, including high revenue, profit margins, and cash flow, are more likely to earn a 5-star rating.

- Growth Potential: Stocks with significant growth prospects, either through innovation, market expansion, or acquisitions, are favored by analysts.

- Market Position: Companies that hold a competitive advantage in their industry, such as market leadership or unique products/services, are often rated higher.

- Management Quality: Effective leadership is crucial for a company’s success, and strong management teams are often a hallmark of 5-star stocks.

- Dividend Reliability: Consistent and growing dividends can indicate financial stability and shareholder value, contributing to a higher rating.

Why Invest in 5-Star Stocks?

Investing in 5starsstocks stocks to invest offers numerous benefits, making them an attractive option for both conservative and aggressive investors.

The Potential for High Returns

One of the primary reasons to invest in 5starsstocks stocks to invest is the potential for substantial returns. These stocks are often associated with companies that are either market leaders or on the cusp of significant growth. As such, they tend to outperform the market, providing investors with the opportunity to reap higher profits compared to more average-rated stocks.

Portfolio Diversification Benefits

5starsstocks stocks to invest can also play a critical role in diversifying your investment portfolio. By including a mix of high-rated stocks from different sectors, you can mitigate risks and enhance the overall stability of your investments. Diversification is a key strategy in reducing the impact of sector-specific downturns, and 5-star stocks often represent a solid foundation for building a resilient portfolio.

Stability and Reduced Risk

While all investments carry some level of risk, 5starsstocks stocks to invest in are generally viewed as more stable than lower-rated alternatives. This stability is often due to the underlying financial strength and market positioning of the companies that earn these ratings. For risk-averse investors, 5-star stocks offer a balance of growth potential and security, making them a preferred choice for long-term investment strategies.

Criteria for 5-Star Stock Ratings

To achieve a 5-star rating, a stock must excel in several key areas. These criteria ensure that only the most promising stocks receive the highest ratings, making them a reliable choice for investors.

Financial Health and Performance

The cornerstone of any 5-star rating is the financial health of the company. Analysts look at a variety of financial metrics, including revenue growth, profit margins, return on equity, and debt levels. Companies that consistently deliver strong financial results are more likely to be rated highly, as they demonstrate the ability to generate profits and manage resources effectively.

Growth Potential

Growth potential is another critical factor in determining a stock’s rating. Companies that are poised for expansion, whether through new product lines, entry into new markets, or strategic acquisitions, are viewed favorably. This potential for future growth can lead to higher stock prices, making these stocks attractive to investors looking for capital appreciation.

Market Position and Competitive Advantage

A company’s position within its industry is a significant determinant of its stock rating. Companies with a strong market presence, such as those with leading market share or a unique competitive advantage, are more likely to earn 5-star ratings. These companies are better positioned to weather economic downturns and capitalize on industry trends, making their stocks more attractive to investors.

Management and Leadership Quality

The quality of a company’s leadership is often a key differentiator in its success. Companies with experienced, visionary management teams are better equipped to execute their strategies and navigate challenges. This leadership quality is often reflected in the company’s performance and, consequently, in its stock rating.

Dividends and Shareholder Returns

For many investors, dividends are an essential component of stock returns. Companies that consistently pay and increase dividends demonstrate financial stability and a commitment to returning value to shareholders. This reliability in shareholder returns is often a factor in achieving a 5-star rating, as it indicates a well-managed, profitable company.

Top 5-Star Stocks to Invest In 2024

As we look toward 2024, certain sectors and stocks stand out as particularly promising. These stocks, spread across various industries, have been identified as top performers with the potential for significant returns.

Technology Sector: Leading the Way

The technology sector continues to be a dominant force in the stock market, driven by innovation and the increasing digitization of our world. Companies like Apple, Microsoft, and Alphabet (Google) have consistently earned 5-star ratings due to their market leadership, robust financial performance, and ongoing growth prospects. These companies are at the forefront of technological advancements, from cloud computing to artificial intelligence, making them attractive long-term investments.

Healthcare Sector: Resilience and Growth

The healthcare sector is another area where 5starsstocks stocks to invest in can be found, particularly in companies involved in pharmaceuticals, biotechnology, and healthcare services. Companies such as Johnson & Johnson, Pfizer, and UnitedHealth Group are known for their strong financials, leading market positions, and the essential nature of their products and services. The aging global population and the ongoing demand for innovative healthcare solutions make this sector a solid choice for investors.

Financial Sector: Stability in Uncertain Times

In times of economic uncertainty, the financial sector often provides a safe haven for investors. Companies like JPMorgan Chase, Berkshire Hathaway, and Goldman Sachs are well-capitalized institutions with strong track records of performance. Their ability to manage risk, coupled with their diverse revenue streams, makes them reliable options for investors seeking stability and consistent returns.

Energy Sector: Capitalizing on Global Demand

The energy sector, particularly companies involved in oil, gas, and renewable energy, continues to be a vital part of the global economy. Companies like ExxonMobil, Chevron, and NextEra Energy have earned 5-star ratings due to their strong market positions, reliable dividends, and potential for growth in the renewable energy space. As the world transitions to cleaner energy sources, these companies are well-positioned to benefit from the changing landscape.

Consumer Goods Sector: Consistent Performers

The consumer goods sector is home to some of the most stable and consistent performers in the stock market. Companies like Procter & Gamble, Coca-Cola, and PepsiCo are leaders in their respective industries, known for their strong brands, global reach, and reliable dividends. These companies have a long history of weathering economic downturns and continuing to grow, making them attractive choices for conservative investors.

How to Choose the Right 5-Star Stocks for Your Portfolio

Selecting the right 5starsstocks stocks to invest in for your portfolio involves more than just picking the highest-rated options. It’s essential to align these stocks with your overall investment goals and consider factors such as performance history, industry trends, and company fundamentals.

Aligning Stocks with Your Investment Goals

Before investing in any stock, it’s crucial to define your investment goals. Are you looking for long-term growth, income through dividends, or a balance of both? Understanding your objectives will help you select the 5starsstocks stocks to invest in that best align with your financial aspirations.

Evaluating Stock Performance Over Time

While a 5-star rating is a strong indicator of a stock’s potential, it’s also important to look at its historical performance. Stocks that have consistently performed well over time are likely to continue doing so, making them safer bets for long-term investment. Analyzing past performance can also provide insights into how the stock may behave in different market conditions.

Understanding Industry Trends

Staying informed about industry trends is critical when choosing 5starsstocks stocks to invest in. Industries that are growing or undergoing significant changes often present opportunities for investors. By understanding these trends, you can identify stocks that are well-positioned to benefit from industry shifts, such as advancements in technology, changes in consumer behavior, or regulatory developments.

Assessing Company Fundamentals

In addition to ratings and industry trends, it’s essential to evaluate the fundamental aspects of the companies you’re considering. This includes analyzing financial statements, understanding the company’s business model, and assessing its competitive position. A strong fundamental analysis will give you a clearer picture of the company’s potential for long-term success.

Risks and Considerations in Investing in 5-Star Stocks

While 5starsstocks stocks to invest in offer numerous benefits, it’s important to be aware of the risks and considerations involved. No investment is without risk, and understanding these factors can help you make more informed decisions.

Market Volatility and Economic Factors

Even the most highly-rated stocks are not immune to market volatility and economic downturns. Factors such as interest rates, inflation, and global economic conditions can all impact stock performance. While 5-star stocks may be more resilient, they can still experience significant price fluctuations, especially in the short term.

Sector-Specific Risks

Different sectors come with their own set of risks. For example, the technology sector is highly competitive and fast-changing, while the energy sector is subject to fluctuations in oil prices and regulatory changes. It’s important to understand the specific risks associated with the sectors in which you’re investing and consider how they might impact your portfolio.

The Importance of Diversification

Diversification is a key strategy in managing investment risk. By spreading your investments across different sectors and asset classes, you can reduce the impact of a downturn in any one area. While 5starsstocks stocks to invest in are generally strong performers, diversifying your portfolio with a mix of stocks, bonds, and other assets can provide additional stability and protection against market volatility.

Long-Term vs. Short-Term Investment Strategies

Your investment time horizon will also influence your approach to 5starsstocks stocks to invest in. If you’re investing for the long term, you may be more willing to ride out short-term volatility in exchange for the potential for higher returns. Conversely, if you’re investing for a shorter period, you may prioritize stability and income over growth. Understanding your time horizon and investment strategy will help you select the right mix of 5-star stocks for your portfolio.

Expert Tips for Investing in 5-Star Stocks

Investing in 5starsstocks stocks to invest in requires a thoughtful approach and a commitment to ongoing research and analysis. Here are some expert tips to help you make the most of your investments.

Research and Analysis: Doing Your Homework

One of the most important steps in investing is conducting thorough research. This includes reading analyst reports, studying company financials, and staying informed about industry trends. By doing your homework, you can make more informed decisions and identify stocks that align with your investment goals.

Keeping an Eye on Market Trends

The stock market is constantly evolving, and staying up-to-date with market trends is essential for successful investing. This includes monitoring economic indicators, geopolitical events, and changes in consumer behavior. By understanding these trends, you can anticipate market movements and adjust your investment strategy accordingly.

The Role of Professional Advice

While self-directed investing can be rewarding, there are times when professional advice can be invaluable. Financial advisors and analysts can provide insights and recommendations based on their expertise and experience. If you’re unsure about your investment choices or need help with portfolio management, seeking professional advice can help you make more informed decisions.

Patience and Discipline in Stock Investment

Investing in the stock market requires patience and discipline. It’s important to avoid making impulsive decisions based on short-term market movements.

Also Read: 5StarsStocks.com Best Stocks: Top Picks for 2024

Frequently Asked Questions

What are 5-Star Stocks?

5-star stocks are those that have been rated highly by analysts based on factors like financial health, growth potential, market position, and management quality.

How are 5-Star Stocks Rated?

Stocks are rated based on a comprehensive analysis of financial performance, growth prospects, competitive advantages, and leadership quality.

Is it Safe to Invest in 5-Star Stocks?

While no investment is completely risk-free, 5-star stocks are generally considered to be among the safer options due to their strong financial performance and stability.

How Can I Find the Best 5-Star Stocks?

Researching analyst reports, staying informed about market trends, and seeking professional advice are all effective ways to find the best 5-star stocks to invest in.

What Sectors Typically Have 5-Star Stocks?

Sectors such as technology, healthcare, financial services, energy, and consumer goods often have 5-star stocks due to their strong performance and growth potential.

How Do 5-Star Stocks Fit into a Long-Term Investment Strategy?

5-star stocks can form the foundation of a long-term investment strategy, offering both growth potential and stability. Diversifying across sectors can help mitigate risks and enhance returns.

Conclusion

The Future of 5-Star Stocks

As we look ahead, the importance of selecting the right 5starsstocks stocks to invest in will only grow. With market dynamics constantly evolving, staying informed and making data-driven decisions will be key to successful investing.

Final Thoughts on Investing in 5-Star Stocks

Investing in 5starsstocks stocks to invest can provide a solid foundation for a successful investment strategy. By focusing on highly-rated stocks across diverse sectors, you can build a portfolio that balances growth potential with stability, ultimately helping you achieve your long-term financial goals.

-

NEWS1 year ago

NEWS1 year agoSearchinventure: Redefining the Digital Experience

-

HEALTH1 year ago

HEALTH1 year agoUnveiling the //vital-mag.net blog: Your Gateway to Health and Wellness

-

NEWS1 year ago

NEWS1 year agoThe Alicia Case in Atlanta: A Deep Dive

-

Pets2 years ago

Pets2 years agoUltimate Strength: Heavy-Duty Tactical Dog Collars for Large Breeds

-

FASHION2 years ago

FASHION2 years agoHow to Style Floral Long-Sleeve Homecoming Dresses for a Glamorous Look

-

BUSINESS1 year ago

BUSINESS1 year agoPedro Vaz Paulo: A Visionary Business Consultant Driving Success

-

NEWS1 year ago

NEWS1 year ago2023-1954: A Journey Through the Decades

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoThe Evolution of Technology: From 1954 to 2023